10/09/2023

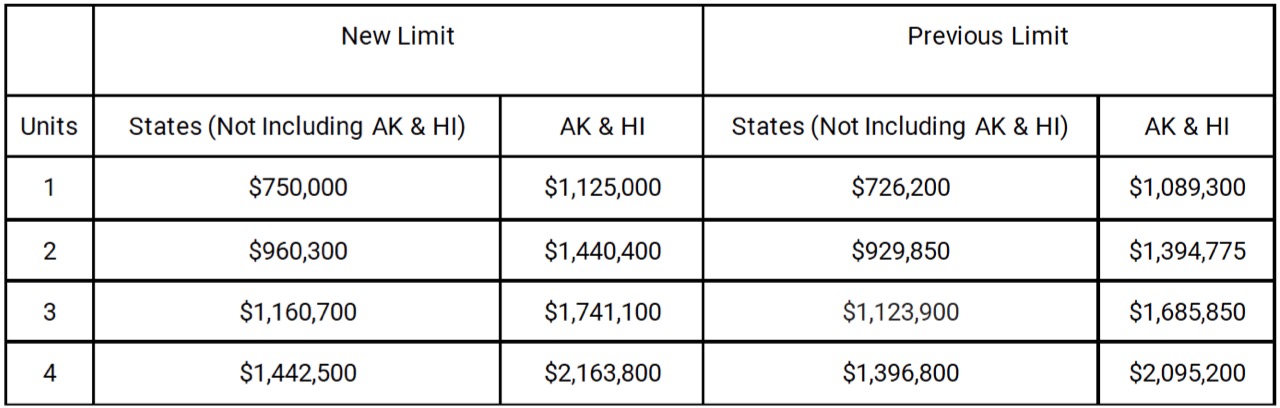

Pennymac Correspondent is excited to announce that we’re raising our Conventional loan limits to $750,000, effective Wednesday, October 11, 2023.

Details:

- Increased loan limits are effective for new locks starting on Wednesday, October 11, 2023 for Conventional loans only. Government loan limits remain unchanged.

- Appraisal waivers with AUS Approve/Eligible will be accepted.

- Loans with AUS Approve/Ineligible (Ineligible for loan limits only) are acceptable but will not be eligible for appraisal waivers.

- Seller may be responsible for re-running the AUS within one week of update to the AUS with the new loan limits.

- We expect that the AUSs will be updated with the official loan limits in early to mid-December.

- As a reminder, credit reports should be no older than 120 days at the time of the AUS re-run.

- If Seller is responsible for re-running the AUS, the updated Approve/Eligible finding must be delivered to Pennymac as soon as available.

- A loan that does not receive an Approve/Eligible finding upon re-run of the AUS will be subject to repurchase unless the sole reason for the Ineligible finding is due to a discrepancy between Pennymac’s posted loan limits and the final conventional loan limits.

Pennymac recommends that Sellers confirm eligibility with their warehouse banks and mortgage insurance partners as early as possible to address any unforeseen issues.

Official 2023 conventional loan limit changes will be determined by FHFA announcement.

Pennymac will update Conventional LLPAs effective for all Best Effort commitments taken on or after Wednesday, October 11, 2023 as follows:

- Add new ‘Loan Balance Adjustments’ Grid

Please contact your Sales Representative with any questions.