PennyMac understands that current conditions are providing unique challenges to the loan origination process. As such, PennyMac is announcing the following.

Verbal Verifications of Employment (VVOE) and Income

Effective immediately, for conventional loans delivered on or after April 2, 2020 PennyMac will require all VVOEs to be completed within 3 business days of the note date. In cases where a traditional VVOE cannot be completed, PennyMac will only accept an email as an alternate VVOE. When an email is used, it must:

- be from the borrower’s direct supervisor/manager or the employer’s HR department, and

- be from the employer’s email address, such as name@company.com, and

- contain all the standard information required on a verbal verification of employment, including the name, title, and phone number of the person providing the verification.

Paystubs and bank statements will not be an eligible alternative VVOEs.

In addition, PennyMac urges Correspondents to closely review all income sources and to carefully qualify borrowers. As borrowers are being impacted by temporary shutdowns and reductions in income, PennyMac recommends Correspondents obtain the most recent paystub. This will better allow Correspondents to more accurately determine the borrower’s ongoing stable income. Borrowers working in industries impacted the most by the current conditions (e.g. service, travel, etc.) should be given additional scrutiny to determine if this income will continue into the future and at the same or similar levels. Lenders should also review processes to take advantage of Day 1. Certainty (D1C) offered by Fannie Mae. If D1C is used, Lenders must close by the date indicated on the DU approval, in addition to all other required D1C requirements. Loans with D1C for employment will not require a VVOE within 3 business days.

As a reminder, Correspondents remain responsible for ensuring all borrowers are employed at their disclosed employment through closing. Because of the rapid changes, Correspondents may wish to implement a separate employment attestation to be completed by borrowers at closing.

At this time there are no alternatives for government loans. However FHA streamline and VA IRRRL transactions can utilize the same flexibilities as conventional loans to meet the VVOE requirement.

Appraisals

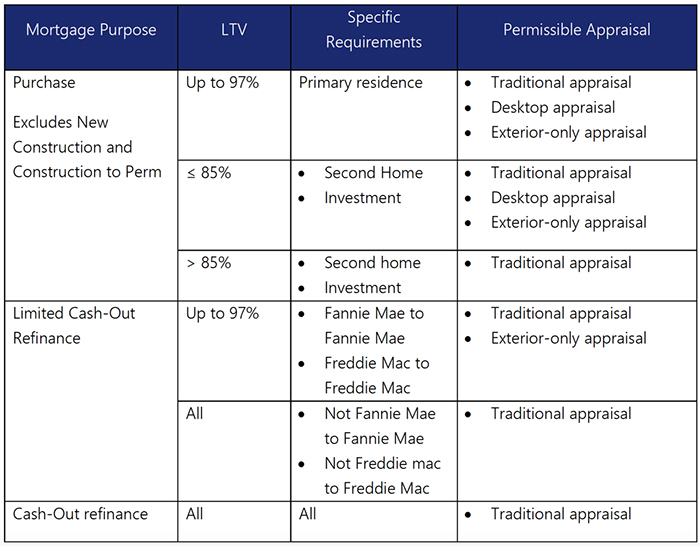

Effective immediately, for all conventional loans, PennyMac is aligning with Fannie Mae and Freddie Mac’s appraisal flexibilities, as listed in the table below. The appraisal flexibilities will remain in effect through loan applications on or before May 17, 2020. Borrowers should be made aware that refusing to allow an appraiser in may delay the loan process.

COVID-19 Related FAQs

- My borrower(s) is employed in the service, entertainment, or other highly impacted industry, how should I qualify my borrower?

The Correspondent is responsible for ensuring the borrower is accurately qualified. If the borrower’s income has been adversely impacted, then the stability of the income may be in question and may render the income ineligible for qualification. Correspondents need to document and justify the income calculation used to qualify all borrowers. - The employer is shut down or I am having difficulty in obtaining a VVOE. Will PennyMac be waiving VVOE requirements?

PennyMac is not waiving any requirements at this time. All full doc loans require a verification of employment. Lenders must continue to follow the end Agency guidelines, and any applicable PennyMac overlays. For conventional loans, a VVOE may be obtained post-close but prior to delivery to PennyMac. - Will PennyMac accept enotaries or remote online notaries (RON) or other distance notarizations?

PennyMac is not accepting any type of electronic or online notary at this time. However, PennyMac is working diligently towards accepting electric notarization and will release additional announcements as information becomes available. - What happens if the recorder’s office is closed? Will PennyMac accept title gap insurance?

Yes, PennyMac will accept loans where title is issuing gap insurance due to recorder’s offices being closed. All loans must have a preliminary title when delivered. However, it is acceptable to provide the recorded docs and the final title as a trailing doc. Several national title companies have confirmed title insurance will still be issued as if the loan recorded. - Will PennyMac be waiving appraisal requirements? My borrower doesn’t want to let in a stranger to their house.

PennyMac is following the appraisal requirements per the end Agency. On conventional loans, Correspondents may want to review for eligibility under the appraisal waiver offers from Fannie Mae and Freddie Mac, or the additional appraisal flexibilities recently announced. Eligibility requirements can be found In Fannie Mae’s Selling Guide B4-1.4-10 and Freddie Mac’s Selling Guide 5601.9. At this time, all government loans require a full interior and exterior appraisal. - Does PennyMac support eNotes without remote notarizations?

PennyMac does currently allow eNotes with specific lender approval. If you are interested, please contact your Account Manager. - My appraisal was done subject to and the appraiser is refusing to complete an inspection. What will PennyMac accept?

For all loans except any HomeStyle or GreenCHOICE loan, PennyMac will accept any of the options allowed by Fannie Mae or Freddie Mac. A letter signed by the borrower confirming the work was completed, along with alternative evidence of completion will be acceptable. Alternative evidence includes photographs of the completed work, paid invoices, etc. Please see Fannie Mae Lender Letter 2020-04 and Freddie Mac Bulletin 2020-05 for additional requirements. PennyMac may request additional documentation depending on the type of repairs needed.