Pennymac will update the footnote for the ‘Purchase Special’ LLPA effective for all Best Efforts Commitments taken on or after Friday, December 02, 2022 as follows:

- Update ‘Purchase Special’ to apply to < = 15 Day Lock Periods

(6) Applies to Purchase transactions, primary residence, loan balances < 200,000, and lock period < = 15 days

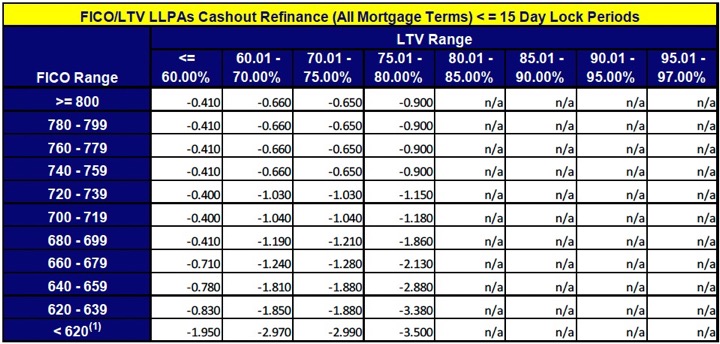

Fannie Mae and Freddie Mac recently announced updates to Loan Level Price Adjusters (LLPA) that will apply to cash-out refinances. Pennymac will update Conventional LLPAs effective for all Best Effort Commitments taken on or after Friday, December 02, 2022 as follows:

- Update ‘Cash-Out Refinance’ < = 30 Day Lock Periods Grid to < = 15 Day Lock Periods

- Update ‘Cash-Out Refinance’ > 30 Day Lock Periods Grid to > 15 Day Lock Periods

Lock extensions and relocks will be subject to the new LLPAs if the loan is delivered after January 01, 2023 and purchased after January 09, 2023, and the new fee was not included previously. The LLPA may not be reflected in the price until after the lock extension or relock has been completed.

Please contact your Sales Representative with any questions.