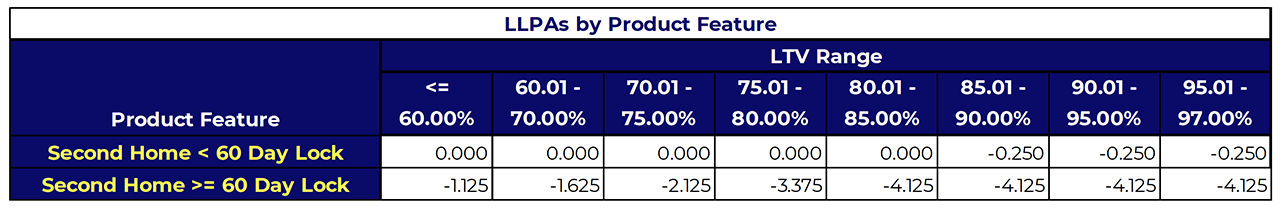

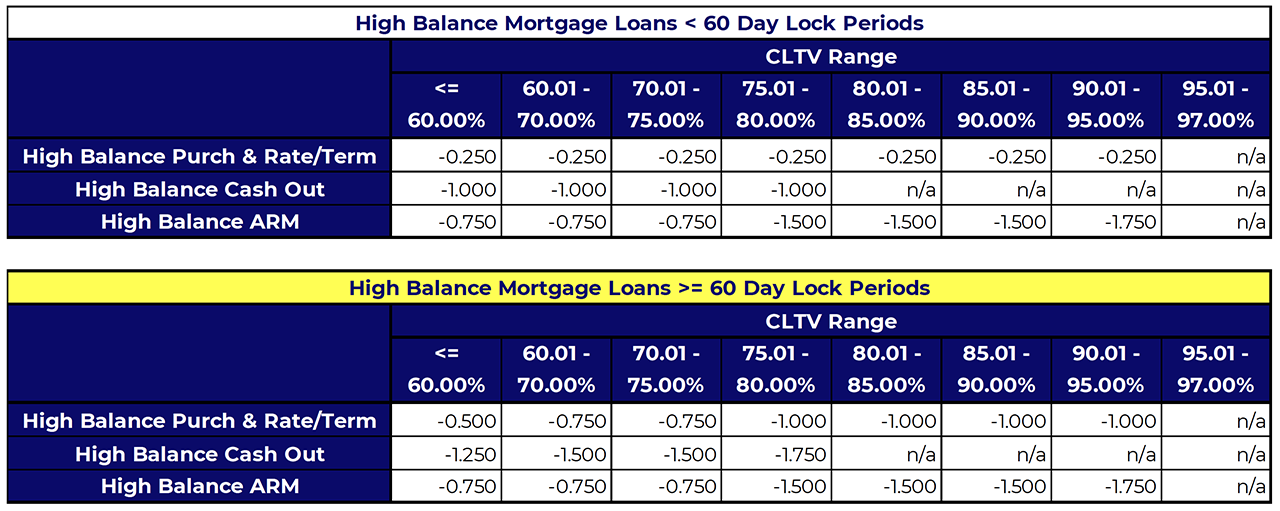

Fannie Mae and Freddie Mac recently announced updates to Loan Level Price

Adjusters (LLPA) that will apply to high balance and second home loans.

Effective Tuesday January 11th, 2022, Pennymac is implementing new Conventional

LLPAs for Best Effort commitments 60 days and longer, as follows:

- Introduce new Second Home >= 60 Day Lock Period LLPA

- Introduce new ‘High Balance Mortgage Loans >=60 Day Lock Period’ Grid

- Lock extensions and relocks will be subject to the new LLPAs if the loan is delivered after March 7, 2022 and purchased after March 17, 2022, and the new fee was not included previously. The LLPA may not be reflected in the price until after the lock extension or relock has been completed.

A sample of the updated rate sheet(s) will be posted to the PennyMac Portal after 11:00 PM (PT) today, January 10, 2022. Sample rate sheet(s) will be available for download shortly after the standard rate sheet email notification is sent from ‘PennyMac Seller Pricing’ <donotreply@pnmac.com>.

Note: Sample rate sheet(s) posted to the portal after 11:00 PM (PT) are intended only to communicate the rate sheet changes as described above. Loan program base pricing will be blank. Rate sheets posted the following morning will be effective for new commitments.

Please contact your Sales Representative with any questions.