Effective immediately, PennyMac is aligning with the guidance given in Fannie Mae’s Updated Lender Letter 2020-03 dated May 19, 2020 and Freddie Mac’s Bulletin 2020-17 for borrowers who are currently in forbearance or other loss mitigation options looking to refinance their current mortgage or purchase

a new home.

Borrowers in Forbearance and Other Loss Mitigation Options

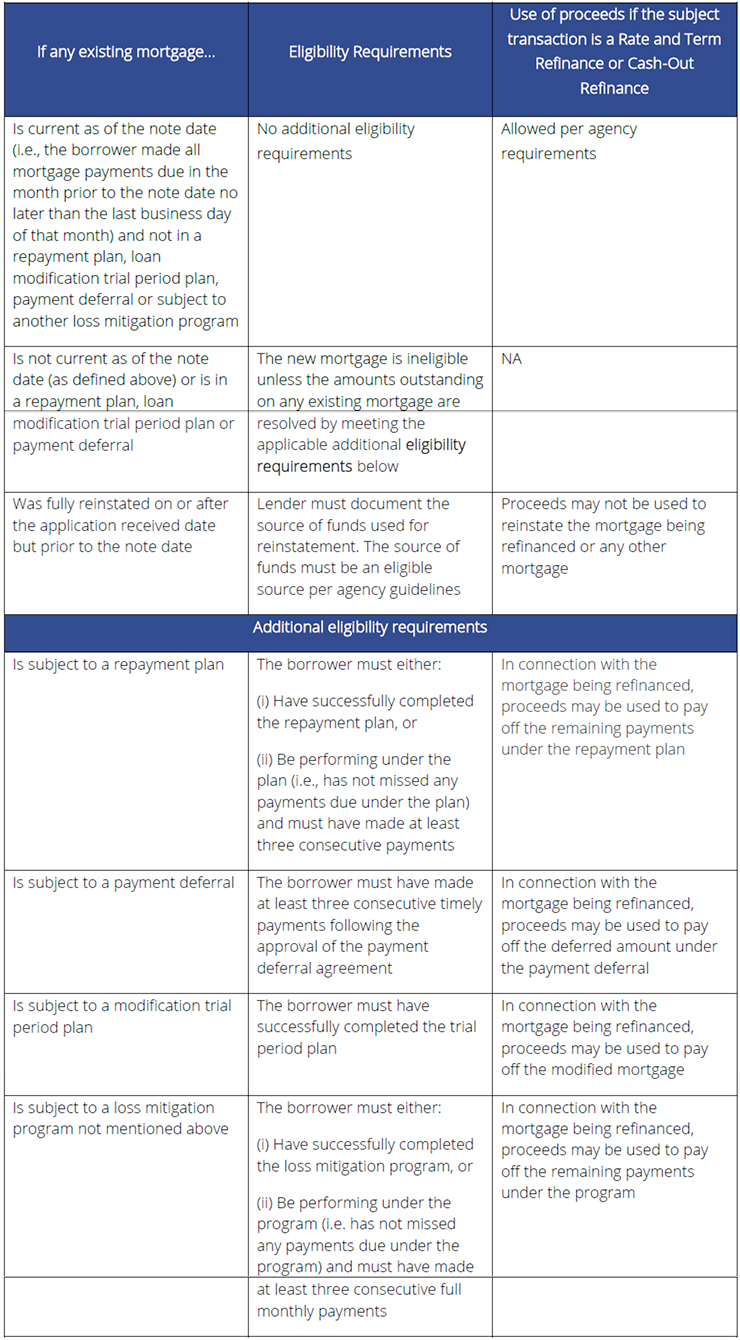

Borrowers that have requested a forbearance due to COVID 19 impacts may still be eligible to refinance their mortgage or purchase a new home if they have met the following requirements on each existing mortgage on which the borrower is obligated that is secured by either the subject property or any other 1 to 4-unit residential property:

Effective with all refinance transactions delivered on or after June 11, 2020, PennyMac will require a payoff demand in the loan file at time of delivery in order to meet the Agency requirements.

In order to verify whether or not each mortgage the borrower is obligated on is current (as defined above), reinstated, in forbearance, or in a loss mitigation option, Lenders must perform additional due diligence beyond the credit report review. Acceptable documentation confirming the loan status and payment status (up to and including month preceding note date) is required and may include (but not limited to) the following: Documentation must be included in the loan file at time of delivery to PennyMac.

- Payment history provided by the servicer(s) for each existing mortgage

- Mortgage statements or electronic mortgage history for each existing mortgage

- Third-party verification service to confirm the mortgage payment history

- Pay-off statements

Due to the complexities in these announcements, PennyMac strongly encourages lenders to review Fannie Mae’s updated Lender Letter 2020-03 and Freddie Mac’s Bulletin 2020-17 in their entirety for complete details. As a reminder, PennyMac does not purchase loans that are currently in forbearance. If the borrower has requested any loss mitigation assistance for the subject transaction including

forbearance prior to delivery, the loan is considered ineligible to be purchased by PennyMac.

Please contact your Sales Representative with any questions.