Release of Fannie Mae Single Close Construction Program

PennyMac is pleased to announce the release of the Fannie Mae Single Close Construction loan program. Program requirements include:

- Owner Occupied, Purchase and Rate/Term refinance

- Minimum FICO of 620 with maximum LTV/CLTV of 97%

- Borrower must make down payment contribution from own funds for LTVs above 80%

- Correspondents must manage project to Fannie Mae’s guidelines

- Seasoning requirements will be measured from completion date on the 1004D versus the note date

- PennyMac will purchase loan transactions after the project has been completed

- Additional flexibility on age of credit and appraisal documentation if specific credit requirements in Fannie Mae B5-3.1-02 are met

- Delegated transactions only

Best Effort rate sheets will be updated May 28th to display the FNMA Single Close Construction pricing. The new ‘FNMA Single Close’ tab will feature base pricing grids.

Please see the PennyMac Fannie Mae Single Close Construction Product Profile for complete details.

Updates to Conventional EPMI LLPAs

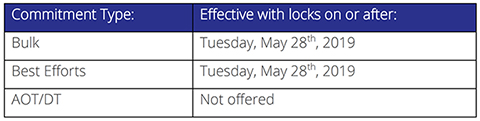

Effective for all commitments taken on or after May 28th, 2019, PennyMac will be updating the EPMI adjustment values on the ‘EPMI LLPAs’ tab of the Best Effort rate sheet.

A sample of the updated rate sheet(s) will be posted to the PennyMac Portal after 6:00 PM (PT) today, May 14th, 2019. Sample rate sheet(s) will be available for download shortly after the standard rate sheet email notification is sent from ‘PennyMac Seller Pricing’ <donotreply@pnmac.com>.

Note: Sample rate sheet(s) posted to the portal after 6 PM (PT) are intended only to communicate the rate sheet changes as described above. Loan program base pricing will be blank. Rate sheets posted the following morning will be effective for new commitments.

Please contact your Sales Representative with any questions.